new DeFi bill

A new bipartisan bill introduced on Tuesday is focused on decentralized finance (DeFi) and its combination with Anti-Money-Laundering (AML) and Know Your Customer (KYC) requirements – and concerns. There is nothing related to innovation in this bill.

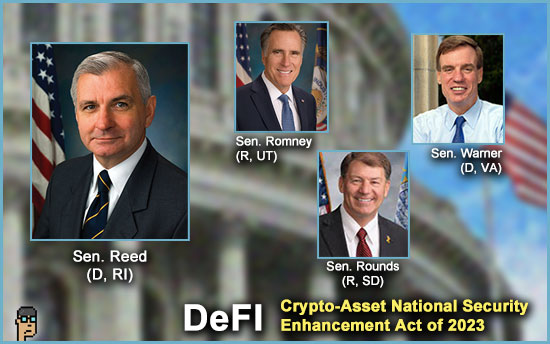

Called the “Crypto-Asset National Security Enhancement Act of 2023” and introduced by Senate Banking Sen. Jack Reed (D, RI) with Senators Mark Warner (D, VA), Mike Rounds (R, SD) and Mitt Romney (R, UT) as co-sponsors.

The bill is known as “S.2355” on Congress.gov or “A bill to clarify the applicability of sanctions and antimoney laundering compliance obligations to United States persons in the decentralized finance technology sector and virtual currency kiosk operators, and for other purposes.” Visit Congress.gov.

CoinDesk reports that the bill places “requirements on ‘anyone who “controls” a DeFi protocol or makes available an application to use the protocol,’ likely a reference to groups who build user-friendly frontends for protocols’ otherwise cumbersome smart contracts, as Uniswap Labs does for Ethereum’s top decentralized exchange.”

Read all about it.

new DeFi bill – ‘purport’

According to the Congressional Record, Sen. Reed said in introducing the bill, “Decentralized finance or ‘DeFi’ refers to cryptocurrency protocols and applications that purport to allow automated peer-to-peer transactions using blockchain technology. DeFi enables users to transact and trade cryptocurrency without requiring a traditional financial institution to broker trades, clear and settle transactions, or custody assets.”

Reed added, “Criminal syndicates, fraudsters, ransomware hackers, and rogue states have been quick to recognize how DeFi can be exploited to advance their nefarious activities. By design, DeFi provides anonymity allowing malicious and criminal actors to evade traditional tools that the government uses to enforce the AML and sanctions laws.” Read more.

The industry association, DeFi Education Fund, didn’t hesitate in offering its ‘take’ on the new bill. From its Twitter account, the Fund said in a thread, “While we are supportive of effective measures to combat the illicit use of DeFi, the bill introduced today essentially says ‘centralize, shut down, or get out of the United States.’ There are far better options that can not only help combat the illicit abuse of DeFi but also do so at a much lower cost to crypto users’ rights and to technological innovation in the United States.”

Digital Chamber of Commerce commented on the bill in a blog post. The industry organization is not impressed: “The Chamber views it as an excessive and misguided approach to addressing security issues related to decentralized finance (DeFi) and Crypto Kiosks.” Read more – including Digital Chamber policy executive Cody Carbone explaining why its a “bad bill.”

more tips:

Regarding “crypto-asset,” do we really need the hyphen?

Continue reading “Bipartisan DeFi Bill Introduced By Senator Reed; Crypto Amendment Bill Update”