HFS markup details released

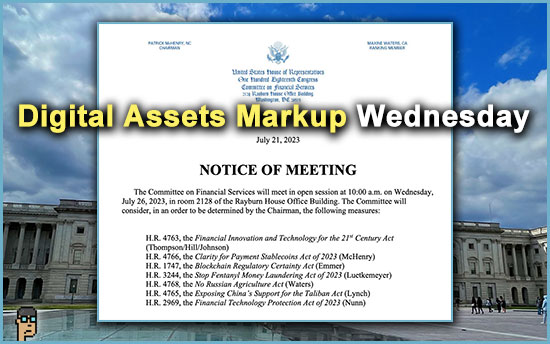

Late Friday, the House Financial Services (HFS) Committee led by Chair Patrick McHenry (R, NC) issued a press release announcing its markup of seven different bills which will commence this Wednesday, July 26 at 10 a.m. at 10:00 a.m. at the Rayburn House Office Building.

See the hearing page. And, view the Memorandum (PDF).

The seven are (links go to Congress.gov):

-

- H.R. 4763, the Financial Innovation and Technology for the 21st Century Act (Thompson/Hill/Johnson)

- H.R. 4766, the Clarity for Payment Stablecoins Act of 2023 (McHenry)

- H.R. 1747, the Blockchain Regulatory Certainty Act (Emmer)

- H.R. 3244, the Stop Fentanyl Money Laundering Act of 2023 (Luetkemeyer)

- H.R. 4768, the No Russian Agriculture Act (Waters)

- H.R. 4765, the Exposing China’s Support for the Taliban Act (Lynch)

- H.R. 2969, the Financial Technology Protection Act of 2023 (Nunn)

Notable among them is the very latest version of the stablecoin bill: H.R. 4766, “The Clarity for Payment Stablecoins Act of 2023”. See the text (PDF).

From the Memorandum on the stablecoin bill: “H.R. 4766 provides a clear regulatory framework for the issuance of payment stablecoins that are

designed to be used as a means of payment. The framework mitigates potential risks posed by payment stablecoins, while at the same time fostering innovation by establishing a tailored approach for new entrants into the marketplace.”

market structure bill – latest

Since issuing a press release last Thursday in advance of this week’s markup hearings, the House Agriculture and Financial Service Committees continued to trumpet the new market structure bill known as – H.R.4763 – “The Financial Innovation & Technology for the 21st Century Act.”

To review, see:

In speaking to House Financial Services (HFS) Committee Chair Rep. Patrick McHenry (R, NC) about the new version of the bill, Politico’s Eleanor Mueller reported Friday that “lawmakers had changed key provisions from the earlier discussion draft in hopes of attracting more Democratic support.”

HFS Chair McHenry tweeted late Friday afternoon, “The Financial Innovation & Technology for the 21st Century Act would not have been possible without the leadership of [GOP HFS Committee] members. I applaud Rep. French Hill (R, AR), Majority Whip Rep. Tom Emmer (R, MN) and Rep. Warren Davidson (R, OH) for their hard work on this unprecedented effort to bring clarity to the digital asset ecosystem.”

more tips:

Market Structure Bill Won’t Restrain SEC and Could Threaten DeFi, Legal Experts Say – Decrypt

Anecdote: In the Twitter-verse, there was confusion on whether unaccredited investors could still buy crypto and to what extent in terms of their net worth. Fox Business reporter Eleanor Terrett, who has reported extensively on digital asset regulation, chimed in with clarification from her perch: “Big takeaway: Unaccredited investors would have an opportunity to get into initial offerings of digital assets.”

Dem strategy: farm bill not crypto

American University professor and crypto critic Hilary Allen provided a well-timed Twitter thread (see it) Friday morning on the market structure bill. Three hours later, Democratic leadership tipped its hand on what may be part of its strategy next week during the markup of the bill.

The Democrats’ House Agriculture Committee Twitter account re-tweeted Allen’s thread and announced, “Instead of focusing on pressing [Farm Bill] issues, House Republicans are sprinting to provide a handout to #crypto exchanges, Wall Street, and Silicon Valley venture capitalists at the expense of American consumers and retail investors.”

Dem strategy: Allen

Looking more closely at Allen’s thread on Friday, she began, “[Republicans on House Financial Services and Agriculture Committees] have dropped text of their digital asset market structure bill, which they’re rushing into markup next week. There are many reasons to pump the brakes on this bill, and I’ll discuss some in this thread. But first – what’s really driving the rush?”

Professor Allen suggested the venture capital community was to blame for the push for crypto regulation and what she called “regulatory entrepreneurship.” Allen pointed to a new, and also well-timed paper she published on the topic. See that one.

Allen is not new to Capitol Hill.

She has been a favorite of Senate Banking Chair Sherrod Brown (D, OH) who has asked her to testify in at least two crypto hearings (Dec. 2021 and Dec. 2022). In mid-April, she provided another well-timed Twitter thread critiquing the new stablecoin bill introduced by HFS Republicans and saying it “won’t fix problems.”

And in late April, Professor Allen was a Democratic choice for an exploratory hearing by House Financial Services on the market structure bill where she argued for a crypto ban: “…the most effective way to protect both the stability of our financial system and individual investors would be to ban the issuance and trading of crypto assets.” Read her testimony.

Dem strategy: stablecoin bill

With the arrival of the latest bill and the markup scheduled for Wednesday, what will Democratic leadership do here? Unlike the market structure bill which has generally considered to be driven by Republicans, a bipartisan effort has been intimated with stablecoins.

Could Democratic leadership encourage a take down of the bill to undermine Republicans in spite of recent stablecoin regulation support from several key Democrats?

U.S. Treasury Secretary Janet Yellen on June 13 stated the need for stablecoin legislation. And, in the House, Rep. Gregory Meeks (D, NY), a senior HFS committee member, told Politico last week, “I’m feeling good about stablecoins. (…) We’ve made tremendous progress there.” Even HFS Ranking Member Maxine Waters was ready to take a run at the stablecoin bill back in March but that quickly changed at the first stablecoin bill hearing on April 19 when she put on the brakes.

Chair Gensler PR ‘playbook’

As suggested in a letter addressed to SEC Chair Gary Gensler last Wednesday, and if history is a guide, there is an expectation of another effort from the SEC to drown out House Republicans’ digital assets efforts during the markup of the market structure and stablecoin bills this week.

HFS Digital Assets Chair Rep. French Hill and House Ag’s Digital Asset Chair Rep. Dusty Johnson (R, SD) wrote last Wednesday, “… This concern is exacerbated by certain Commission actions, seemingly timed to coincide with related Congressional activity, which appears calculated for maximum publicity and political impact.”

Fortune’s Jeff John Roberts created an infographic in June connecting House legislative efforts on digital assets with SEC enforcement actions or a PR tactics involving Chair Gensler. See the graphic.

And, read the article on “Gary Gensler’s crypto playbook.”

What will be the Chair’s tactics this week, if any?

cannot see

The Crypto-Asset National Security Enhancement Act of 2023 continues to get no love from any members of the digital assets community. The new bipartisan bill, a.k.a. the CANSEE Act, was introduced last week by Senator Jack Reed (D, RI) with co-sponsors Senators Mark Warner (D, VA), Mike Rounds (R, SD), and Mitt Romney (R, UT).

The DeFi Education Fund devoted the opening of its weekly newsletter on Friday to CANSEE concluding, “We of course share the senators’ goal of reducing the illicit abuse of DeFi, and there are ways to do so that can coexist with the core characteristics of public blockchains and protocols. Unfortunately, the CANSEE Act does not thread this needle because it would effectively ban DeFi development in the United States.”

stablecoin ratings

Earlier this month, a new service focused on providing stablecoin ratings was launched by bluechip.org. The site, which provides its methodology (PDF), shows that Binance’s BUSD and the Gemini Dollar GUSD are among the “A-rated” group. Tether, the world’s largest stablecoin, is rated “D”.

Bluechip.org‘s CEO is Austrian Ben Levit and its Macro Economist is Garett Jones from George Mason University. The company lists supporters which include members of the George Mason University faculty, such as Tyler Cowen, as well as several Web3 entrepreneurs and venture capitalists.

Follow Bluechip.org on Twitter here.

more tips:

On Saturday, HFS Chair Patrick McHenry re-tweeted equity researcher John Paul Konig’s short review of the Bluechip.org’s service. This service is on Congress’ radar.

Ripple skepticism

Capitol Account talks crypto policy and the Ripple case with Duke University lecturing fellow Lee Reiners. Both Capitol Account and Reiners remain very skeptical about the impact for District Judge Analisa Torres decision, which said that Ripple’s XRP token was not a security in certain instances.

Reiners, who has testified before Congress on crypto at an HFS Digital Subcommittee hearing in early March, says about the digital assets industry’s reaction to the decision, “They’re proclaiming this is a death blow to the SEC’s quote-unquote regulation by enforcement agenda. Obviously that’s not true. First, it’s important to note that the Ripple case was initiated by [Trump SEC Chair] Jay Clayton. The industry is sort of spiking the football at Gensler’s face. Gensler supported the enforcement action, but this was a Clayton-era case. Second, it’s not precedent throughout the country… ” Read the interview.

In fact, The Wall Street Journal reported that the SEC is skeptical about Judge Torres’ decision, too: “The SEC wrote Friday that the judge hearing Kwon’s case shouldn’t look to the Ripple case as precedent. Torres’s decision ‘adds baseless requirements’ to the test for when an asset is a security, the SEC said.” Read more.

see more tips

Coinbase to fully sunset bitcoin-backed loan program for retail customers – The Block

DoJ Accuses SBF of Leaking Caroline Ellison’s Diary to ‘Discredit a Witness’ in FTX Trial – Decrypt

Couple to Plead Guilty in $4.5 Billion Bitcoin-Laundering Case – The Wall Street Journal