Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

Market Structure – House Agriculture

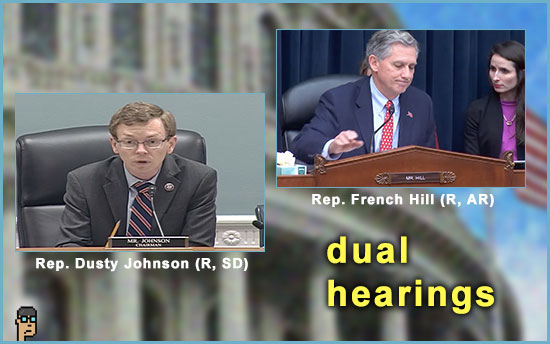

It was a day of cooperation among Republicans yesterday as the House Republican majority convened two simultaneous hearings that began their quest for more and better market structure in digital assets.

Rep. Dusty Johnson (R, SD), Chairman of the House Agriculture’s Subcommittee on Commodity Markets, Digital Assets, and Rural Development, said in his opening statement, “[There]’s plenty of work for our regulatory agencies to do, including the CFTC, the SEC, and our state and federal banking regulators.”

In his statement, House Ag Chair Rep. Glenn “GT” Thompson (R, PA) reiterated his Committee’s partnership with Chair Rep. Patrick McHenry (R, NC) and the House Financial Services (HFS) Committee. See the House Ag Subcommittee hearing video and list of witnesses who participated here.

more tips:

Urgency appears to be the message from Republicans on digital assets, as House Ag and HFS said they will partner again next month on digital assets legislation in a combined hearing according to a release. Read more from Financial Services Committee (Majority).

Market Structure – HFS

Meanwhile, Chair Rep. French Hill (R, AR) guided the market structure hearing on HFS Subcommittee on Digital Assets, Financial Technology and Inclusion. The hearing’s Committee Memorandum read in part, “Committee Republicans seek to establish a digital asset market structure framework appropriate for the unique characteristics of digital assets. This framework would provide digital asset firms with regulatory certainty and prevent the regulatory turbulence created by jurisdictional infighting and punitive enforcement actions.”

See the hearing video and list of five witnesses which included Marta Blecher, President of Filecoin and Hilary Allen, a previous Senate Banking witness and law professor from American University.

Democrats were not interested in the pursuit of market structure if HFS Ranking Member Rep. Maxine Waters’ (D, CA) opening statement was any indication. She pointed to the SEC’s “success” to this point and said, “[We] do not need to create an entirely new and special framework for crypto—we already have one. Rather, crypto firms, like other tech companies before them, must recognize that they are not exceptional; they need to comply with the laws of the land. To the extent there are actual gaps in our laws, such as limitations on the SEC’s reach overseas, we should focus on those, and not on creating more complexity through a whole new regulatory framework.” Read the statement.

more tips:

“SBF’s ‘ghost is still in this room,’ congressman [Rep. Brad Sherman (D, CA)] says at digital asset hearing” – The Block Continue reading “Market Structure Hearings For House Ag and Financial Services; Coinbase’s Ire”