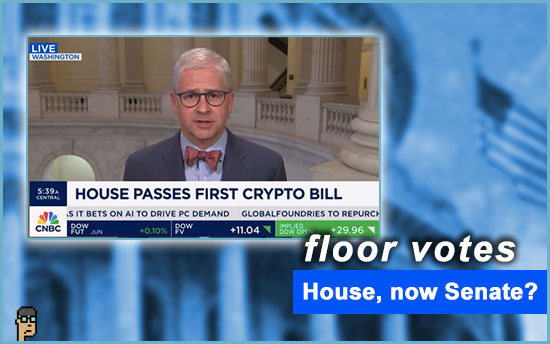

anti-CBDC bill – passage

Yesterday afternoon, The “CBDC Anti-Surveillance State Act” [H.R.5403] from Majority Whip Tom Emmer (R, MN) passed along nearly partisan lines on the House Floor. The bill effectively bans a Central Bank Digital Currency (CBDC) without Congressional authorization.

The bill passed 216-192. 22 members did not vote.

As expected, the bill with 165 Republican co-sponsors, was unanimously approved by House Republicans.

Three Democrats broke from Dem leadership and voted for the bill: Reps. Jared Golden (ME), Mary Sattler Peltola (AK) and Marie Gluesenkamp Perez (WA).

Visit the Clerk’s website for H.R. 5403’s complete tally.

Whip Emmer celebrated the passage in a tweet thread after the vote, “My legislation ensures that the United States’ digital currency policy remains in the hands of the American people so that any development of digital money reflects our values of privacy, individual sovereignty, and free market competitiveness.”

more tips:

-

- View: “Full answer from [Treasury Secretary Janet Yellen] on a digital dollar ahead of this afternoon’s vote on Majority Whip Tom Emmer’s bill to ban the Fed from offering one.” – Brendan Pedersen, Punchbowl News on X

what you should know: This is an important message bill for House Republicans that likely won’t see the Democrat-controlled Senate Floor this Congress (let alone the White House). But, if votes fall the Republicans way in the November election, this bill could make it into law in the next Congress. Continue reading “Congressional Letter Sent And ETFs Begin Approvals; FIT 21 Reverberates; Anti-CBDC Bill Passes”