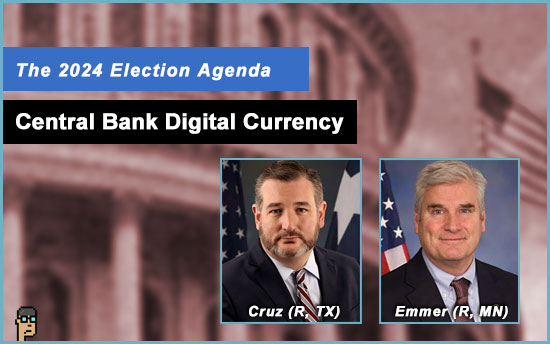

Cruz joins CBDC bill

Yesterday, Senator Ted Cruz (R, TX) brought his “upper house” seal of approval to anti-CBDC (Central Bank Digital Currency) sentiments currently being driven by Majority Whip Tom Emmer (R, MN) and his “CBDC Anti-Surveillance State Act” [H.R.5403] which includes 97 Republican co-sponsors.

Republicans see opportunity with the CBDC issue in the 2024 general election says Fox Business.

Senator Cruz, the Ranking Member on Senate Commerce, shares with Fox that he and five “Senate colleagues, including Bill Hagerty (R, TN), Rick Scott (R, FL), Ted Budd (R, NC), Mike Braun (R, IN), and Kevin Cramer (R, NC), will sponsor a new bill called the Central Bank Digital Currency Anti-Surveillance State Act.” Read more.

Treasury rumor

Commodity Futures Trading Commission (CFTC) Commissioner Kristin Johnson may be getting a new job. Politico reported yesterday that she’s under consideration for Assistant Secretary for Financial Institutions at Treasury. Read more from Politico (subscription).

Commissioner Christy Goldsmith Romero (D) has also been rumored for the position.

Commissioner Johnson, a Democrat, has been active on issues related to digital assets including public speaking at events such as Blockchain Association’s Policy Summit last November (her remarks). When she first arrived at the Commission in 2022, she moderated a CFTC webcast titled “Digital Assets and Financial Inclusion.” Continue reading “Cruz Joins Emmer On Anti-CBDC Crusade; Reps. Flood And Nickel Talk SAB 121 With Consumers”