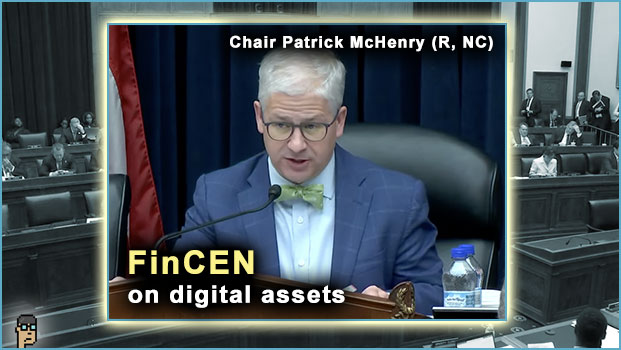

FinCEN hearing

Yesterday’s House Financial Services (HFS) hearing focused on U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) included attention to digital asset matters.

Republicans expressed skepticism (see Chair Patrick McHenry’s comments) about some FinCEN processes and largely focused on the unnecessary data grab and resources required by FinCEN with programs such as those enabled by the Corporate Transparency Act (CTA). The CTA requires businesses to register their beneficial owners by the end of the year. So far, according to FinCEN witnesses Treasury Undersecretary Brian Nelson and FinCEN Director Andrea Gacki, 500,000 out of 32 million have complied thus far.

Among the digital assets highlights…

Crypto gadfly Rep. Brad Sherman (D, CA) said during his Q&A time that pro-crypto advocates were trying to “de-fang” the U.S. government with cryptocurrency.

Rep. Bill Foster (D, IL) explored the efficacy of secure digital IDs and suggested that it would have “huge benefits to the federal taxpayer” in its ability to stop fraud.

Rep. Sean Casten (D, IL) explored illicit finance and digital assets during his Q&A time. He wanted Treasury’s Nelson to highlight why “bad guys like mixers” – Nelson and Director Gacki said that mixers essentially anonymize transactions that “shield illicit finance.” Casten introduced the phrase “chain hopping” and said it was a problem with illicit finance.

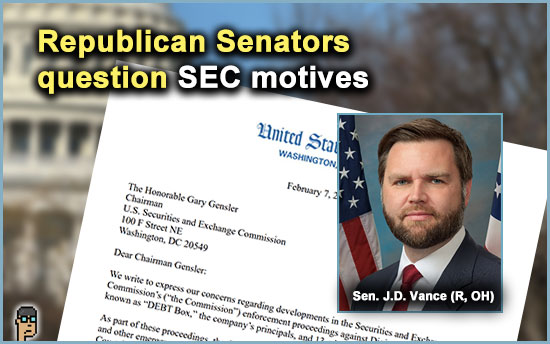

Majority Whip Tom Emmer (R, MN) brought up “the erroneous Wall Street Journal report” on October 10 regarding Hamas, illicit finance and crypto. He asked Undersecretary Brian Nelson about how much crypto was actually received by Hamas. Nelson demurred and said he could share info privately which the Whip took him up on.