this week – prudential hearings

Prudential regulators – the Office of the Comptroller of the Currency (OCC), the Federal Reserve Board of Governors (Fed), the Federal Deposit Insurance Corporation (FDIC) – will be meeting with the House Financial Services (HFS) Committee on Wednesday and Senate Banking on Thursday.

There are no digital assets topics on the HFS Committee’s memo (PDF), but the prudential group has been active in the digital assets discussion with the Committee in the past.

In March 2023 (letter) and then again in November 2023 (letter), HFS Chair Patrick McHenry (R, NC), and Senator Cynthia Lummis (R, WY) spearheaded an effort to get the prudential regulators to admit that SAB 121 was a bad idea, in so many words.

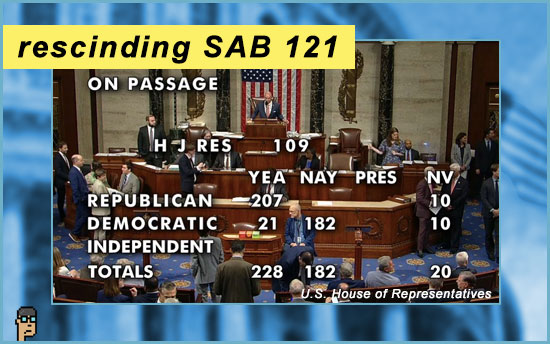

The House passed a resolution last week rescinding SAB 121 – the Senate, and then the President will be next.

Scheduled to appear on Wednesday at the HFS hearing are:

-

- Michael Barr, Vice Chair, Federal Reserve

- Martin Gruenberg, Chair, FDIC

- Michael Hsu, Acting Comptroller, OCC

what you should know: The literal “elephant in the room” for both hearings will be FDIC Chair Martin Gruenberg and his resignation which Republicans want and Dem leadership does not want (such as Senate Banking Chair Sherrod Brown (D, OH) – read) over the recent sexual harassment scandal at the FDIC. Read about it in the WSJ.

more: DOJ, money transmission

Following up on news from Punchbowl on Sunday, Senator Cynthia Lummis’ (R, WY) office published a press release yesterday about the Congressional letter penned by the Senator and Senate Finance Chair Ron Wyden (D, OR) expressing concerns to Attorney General Merrick Garland. The Senators say that the DOJ’s recent interpretation of what constitutes a money transmitter – rules originally set up by the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) – are troubling. Continue reading “Prudential Regulators Join Oversight Hearings This Week; Tornado Cash Decision Today”