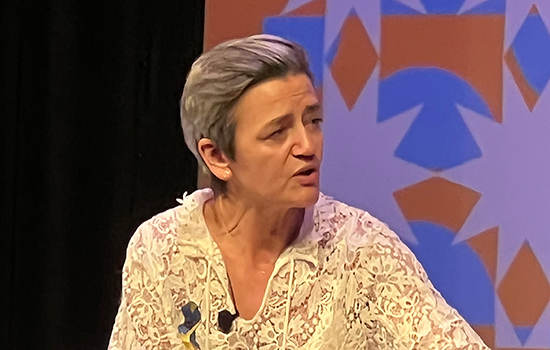

In an hour-long interview at South by Southwest in Austin, Texas, Margrethe Vestager, Executive Vice President of the European Commission, offered the European regulator view on technology in the 21st century.

Though her purview does not necessarily cover cryptocurrency as CNBC interviewer Sara Eisen pointed out, Vestager did chime in on blockchain and non-fungible tokens (NFTs), specifically.

She signaled hopeful curiosity:

“The NFT is a new thing. I find it really interesting because, first of all, it questions everything you know about value. And second, maybe it’s a new way for artists and musicians and to get a stronger bite of the value that they create? And that obviously is really interesting. So we follow [it], but it takes us a bit of time because we start to recruit new people [at the European Commission] – not every lawyer is a gamer (jokingly). We need to get more people on board.

I had a very interesting experience because I had at a group of three people advising me during the last mandate when we were preparing the Digital Markets Act. It was a lawyer, an economist and a technologist. To see the three of them working together was really interesting because it took them some time to get used to it. But then once they did, what they achieved was really interesting.”

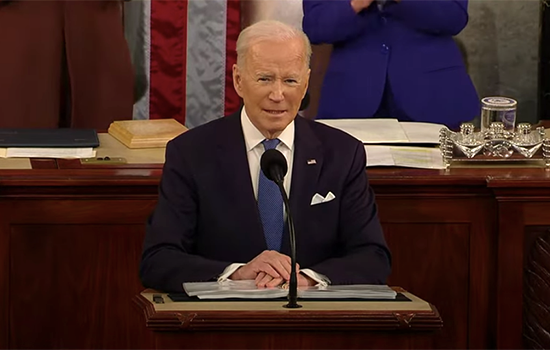

On tech regulation momentum coming from Washington DC

Continue reading “EU’s Vestager Hails NFTs as a New Way To Value and Compensate”