do not approve

A March 11 Congressional letter signed by Senator Jack Reed (D, RI), author of the CANSEE Act, and Senator Laphonza Butler (D, CA) expresses concern to Securities and Exchange Commission (SEC) Chair Gary Gensler about the recent approval of Bitcoin spot market Exchange Traded Products (ETPs) saying the Commission has provided “a green light for Wall Street to sell volatile cryptocurrency investments to ordinary Americans through their brokerage and retirement accounts.”

Since approval of the Bitcoin ETPs, the price of Bitcoin has doubled and poured fuel on the fire in regards to support for future crypto-backed products – such as an Ether ETP.

Going forward, the Senators tell Chair Gensler that the SEC “is under no obligation to approve such products, and given the risks, it should not do so.” Read it.

(h/t @Alexander Grieve)

more on terrorism, digital assets

Politico added more (or different) color to the use of crypto by the terrorist organization Hamas when comparing to a story reported on Wednesday by The Wall Street Journal.

Politico says the new letter from Treasury on crypto assets is from Deputy Treasury Secretary Wally Adeyemo and was sent to Senate Banking Chair Sherrod Brown (D, OH). The letter “warned of continuing concerns about the extent to which Hamas and other terrorist groups will turn to digital currency for financing.” Read a bit more.

more tips:

-

- Politico also covers new findings by The Atlantic Council on global CBDC adoption. Read here, too.

CBDC agenda

House Majority Whip Tom Emmer (R, MN) published a photo (see it on X) of a Federal Reserve document which appears to show that the Fed considers Central Bank Digital Currency (CBDC) development a key duty.

Though Fed Chair Jerome Powell said CBDCs were not going to happen anytime soon – or without Congressional authorization – at a Senate Banking hearing last week, Decrypt reports that former Fed Vice Chair Lael Brainard said in the past that she saw CBDCs “as a tool for reinforcing global dollar dominance, and “safe central bank liability in the digital financial ecosystem.” Read more.

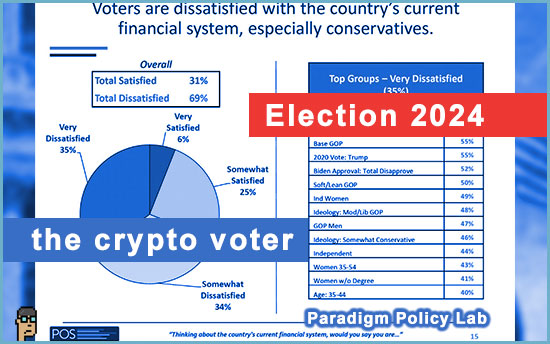

the crypto voter

Yesterday, Paradigm policy executive Justin Slaughter shared new findings on crypto voters from a Paradigm Policy Lab survey published Wednesday. “First, 19% of registered voters have bought crypto, which is roughly what we and other polling operations have found in the past. Ownership of crypto skews highest among younger voters, nonwhite voters, and men,” tweeted Slaughter.

The opinion poll data includes the views of 1,000 registered voters recruited by Paradigm and undertaken a “few weeks ago.”

See the complete findings here.

McHenry next week

On Tuesday of next week, House Financial Services Chair Patrick McHenry (R, NC) will be appearing at a Punchbowl News event titled, “The Summit: The Digital Payments Economy.” Registration is here.

Chair McHenry will also be appearing at Coinbase’s “Update the System Summit” the next day.

hear ye, hear ye

The House Financial Services Capital Markets Subcommittee led by Chair Ann Wagner (R, MO) will be holding a hearing next Wednesday, March 20, titled, “SEC Overreach: Examining the Need for Reform.” No witnesses are listed, yet. See the hearing’s web page.

what are “blobs”?

For those living and breathing the Ethereum blockchain ecosystem, the introduction of “Blobs” to Layer 2 Ethereum blockchains is a huge innovatio which will reduce transaction costs while speed them up at the same time.

Blockworks explains, “What broadband did for the internet, blobs are now doing for Ethereum. Blobs give the raft of layer-2s their own space through which to post transactions to the Ethereum mainnet without clogging up the blockspace intended for other users.” Read it.

getting rich

New on-chain analysis released Wednesday from blockchain analytics firm Chainalysis says that – even in the crypto “bear market” which took place during most of 2023 which eventually trended up – users were profiting from ownership of cryptocurrencies.

Contelegraph covers the news, “The United States ranked first in the list by a ‘wide margin’with $9.36 billion in estimated realized gains over the year. The United Kingdom stands second with an estimated $1.39 billion in earned profits. Vietnam, China, Indonesia, India, Russia, and South Korea are also among the countries with realized gains of over $1 billion.” Read more.

The way things are going in 2024, these 2023 numbers may look miniscule at the next report.

more tips:

-

- 2023 Cryptocurrency Gains by Country – Chainalysis

- JPMorgan says bitcoin rally ‘propagated’ by retail and speculative institutional investors – The Block

M-T-D fails

On Wednesday in a New York District Court, crypto exchange Gemini and digital asset financial services firm Genesis failed to have their motion-to-dismiss accepted by the court in the complaint brought in early 2023 by the Securities and Exchange Commission (SEC) against Gemini Earn staking product. The Wall Street Journal reports that “The SEC said Gemini Earn should have complied with investor-protection laws because the program qualified as an investment contract, a catch-all category in securities laws for assets that aren’t stocks or bonds.” Read it.

Consensys counsel Bill Hughes examines the decision point-by-point on X. He says about the decision in part, “It’s premature to strike SEC’s request for a permanent injunction of the Earn program, and Gemini will remain active in crypto so such relief may be warranted.” Hughes makes his final point saying, “It’s premature to strike SEC’s request for disgorgement of any profits from the Earn program. If the SEC wins the case, then Gemini might be forced to give up what they earned unjustly.” Read the complete analysis on X.

you’re hired

Bank Policy Institute Hires Michael Wong as SVP, Government Affairs -formerly a Senior Advisor to Senator Kyrsten Sinema (I, AZ) – BPI

permission warning

In an op-ed on CoinDesk, Linda Jeng, founder and CEO of consultancy Digital Self Labs, makes the case that from a cybersecurity perspective, an on-chain future is better for the traditional banking system than an off-chain future.

She concludes, “Encouraging the use of permissioned networks over permissionless blockchains will inevitably lead to cybersecurity attacks on a scale previously unknown as the financial system moves to tokenize trillions of dollars’ worth of real world assets and liabilities. The biggest bank heist in history is in the making.” Read the entire piece.

still more tips

Buy Robinhood as Crypto ‘Monster’ Cycle Dawning, Bernstein Says – Bloomberg

Mastercard-owned CipherTrace tells clients it is shutting down key products – Fortune on Yahoo

Stablecoin supply jumps to $146bn, biggest since FTX collapse – DL News

First ever Israeli shekel-backed stablecoin approved for pilot launch – CalcalistTECH