stablecoin and money laundering

Last week, anonymous sources tell Bloomberg that U.S./U.K. authorities are investigating $20 billion in crypto transfers of the Tether stablecoin through Russian crypto exchange Garantex. Bloomberg says, “The transfers have taken place since Garantex was sanctioned by the US and UK on suspicion of enabling financial crimes and illicit transactions in Russia.” Read more.

Last October, the Wall Street Journal reported that Garantex – in spite of sanctions issued in 2022 – had a booming business which included potential involvement in the funding of terrorism and, in particular, Hamas. Read that one from October 13.

more tips:

-

- Treasury Sanctions Russia-Based Hydra, World’s Largest Darknet Market, and Ransomware-Enabling Virtual Currency Exchange Garantex (April 2022) – U.S. Treasury

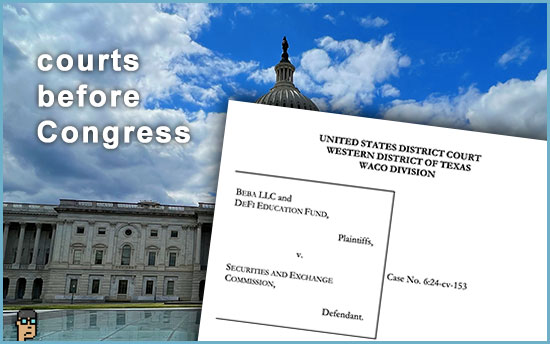

what you should know: Is this latest news more fuel to the fire of anti-money laundering bills such as Senator Elizabeth Warren’s (D, MA) Digital Asset Anti-Money Laundering (DAAMLA) bill or Senator Jack Reed’s (D, RI) CANSEE Act? Or maybe Rep. Sean Casten (D, IL) will finally be able to find a Republican partner for the House version of DAAMLA? Continue reading “Stablecoin Runs Afoul Of Sanctions; Anti-CBDC Bill Could Ride Along Any Digital Asset Bills”