Are Synthetics a Fad or Breakthrough for Finance?” at SXSW, Cake Defi Founder and CEO Julian Hosp did his best to bring clarity to many of the late-breaking developments in tokenization models across decentralized finance (DeFi) for an eager SXSW audience.

Were some in the audience from the SEC? Hard to say – but given the questions during the Q&A, lawyers were most assuredly in attendance. Today, the decentralized finance services of Singapore-based Cake Defi (offering staking, liquidity mining and lending) are available everywhere but the U.S., according to Hosp. Yet, he believes the positive implications of decentralized finance go far beyond today’s stock investors and includes the possibility of reaching a global population with limited access to funds and technology.

One other important underlying theme running throughout the hour-long presentation: decentralized finance is about creating tokens that are not a security with its incumbent regulatory framework. This is the hill that DeFi is trying to climb. Given Cake Defi’s recent announcement of its very own venture arm with $100 million of capital, the race is on to grow the space.

For context, Coin Telegraph published a backgrounder article in October 2021 on the developing space and defined the “synthetics” term:

Synthetic assets are artificial renditions of existing assets whose prices are pegged to the value of the assets they represent in real-time.

For CEO Hosp, the controversy of Wall Street stock trading app Robinhood and its centralization which famously stopped trading Gamestop shares in January 2021 were the seeds of his company’s next opportunity: “Would it not be possible to put the stocks on a blockchain [where] no one can take them away from you? They could not be moved around, and you would have proven digital ownership.”

He pointed to three things that are needed to provide proper decentralization for a stock token solution -which presumably would not run afoul of securities laws by maintaining the tokens property classification and that it’s not a security.

Using a Tesla share as an example, Hosp sees three requirements for tokenization:

-

-

- The Issuing – So if you have a centralized custodian, that custodian takes the Tesla share and issues, centrally, a token onto the blockchain. (…) This is the easy part and done via blockchain smart contracts, and there are many blockchains out there who have tried to solve this – Ethereum, Synthetix, Mirror, DeFiChain.

- The Backing – With a centralized traditional token model, the token is always backed one-to-one with the underlying, so one Tesla share represents one Tesla token. But with DeFi, the backing is done by cryptocurrencies. So, instead of locking up a Tesla share, you have to lock up more value than a Tesla share is in the form of cryptocurrencies. (Hosp: “The issuing and backing are relatively easy for most blockchains to do because they stay in the ecosystem.)

- The Pricing – The hardest part is this one, says Hosp. How does the blockchain know in that the blockchain is nothing more than a community that agrees on a database? So in his example, how does this group of people with this database know how much Tesla is trading in the real world especially if it’s the weekend, for example, and Tesla is not trading at all. The key to this part of decentralized pricing are oracles (Not the company! …think API or data feed).

-

In a detailed presentation titled, “To date, Hosp didn’t see any single blockchain having solved pricing perfectly yet. Blockchains use oracles – or adaptors to real world market data. The more and diverse oracles you use, the better. He said, “You want market data that’s diverse.”

In a detailed presentation titled, “To date, Hosp didn’t see any single blockchain having solved pricing perfectly yet. Blockchains use oracles – or adaptors to real world market data. The more and diverse oracles you use, the better. He said, “You want market data that’s diverse.”

Hosp set the premise for tokenization and its benefits with the decentralized finance framework using one share of Tesla as an example:

“If share of Tesla trade at $1,000, it would actually be good if one of these (oracle) providers says ‘Tesla shares are trading at 1050,’ and the other one says, ‘It’s actually trading at 980.’ So, there’s different market data and the oracle automatically prices it into the smart contract at an average or at a weighted average because then the fluctuation of the oracle prices it a bit higher.

The thing you don’t want to have is an oracle price that exactly mirrors a trading price on a traditional trading platform for the simple reason: ‘Walks like a duck, talks like a duck, looks like a duck – it is a duck (therefore, it would be a security).’ It’s quite important that there is a decentralized pricing.”

Necessity of Collateral

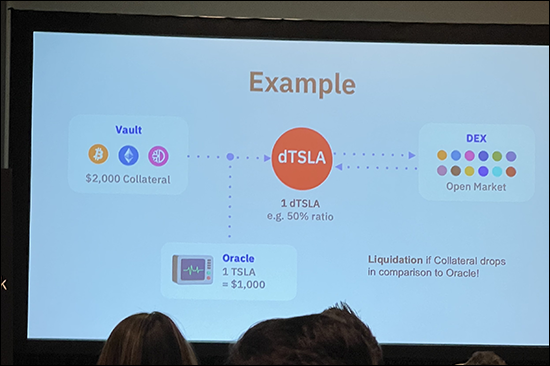

Reviewing the details on the blockchain, Hosp said you need create a vault which resembles the custodian, but isn’t a custodian. Instead of putting the Tesla share in, you put in a decentralized token or cryptocurrency. And the, you lock in more than whatever is needed to create that token. Hosp offered:

“For example, you need to use a 50% ratio. What does this mean? In this case, Tesla trades at $1,000. The minimum you have to lock in is $2,000. And that allows you to create this token on a blockchain.

If Tesla in the real world goes up, and if it were to break a liquidation level, that Tesla token would liquidate and pay out the collateral to its investors. This is not hocus-pocus. This is actually happening right now.”

Hosp claimed that you can go to DeFi apps today and see how it works with various tokens – presumably not in the United States as it relates to his Tesla share example.

Switching to the decentralized token version of a Tesla, he called this “dTesla” for explanatory purposes vs. plain ole Tesla stock. He explained again, if dTesla was the same as Tesla, dTesla would be a security, and you would not solve anything. So [in DeFi, these two, once again,] cannot be the same.

Pushing further, Hosp asked the audience to imagine Tesla trading at $1,000 per share on the actual stock market. Consequently, the pricing signals from several different oracles tell the blockchain that participants in the new dTesla tokens need to have at least $2,000 in collateral or more -and then these dTesla tokens can be created. If the vault drops below $2,000 per Tesla token automatically a dTesla token on the DEX (decentralized exchange) will be sold for the underlying cryptocurrency.

Meanwhile, the blockchain incentivizes the buyer to lock-up their crypto and create these currencies or tokens with rewards said Hosp.

And that’s just the beginning – more to come from decentralized finance and synthetics.

Get More:

-

-

- DeFiChain to Offer Tokenized Versions of Apple, Tesla – Bloomberg (subscription may be required)

-