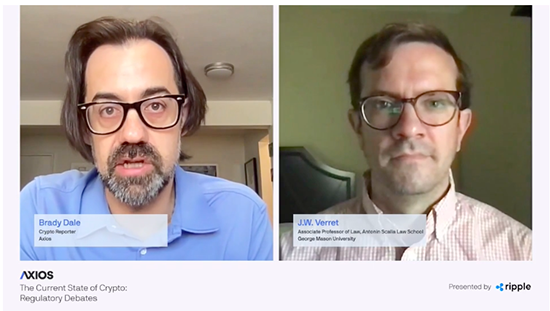

In today’s Axios live webcast, Axios crypto reporter Brady Dale asked law professor J.W. Verret of George Mason University, if the long-awaited spot ETF is ready for prime time.

Brady Dale: The argument against a Bitcoin ETF for allowing people in their brokerage accounts to own Bitcoin, through publicly traded instruments has mainly been the market is too small and it’s too easy to manipulate. But, the market is now three times bigger than it was when the Winklevoss brothers first proposed an ETF in 2017. How big do you think it needs to get before it’s big enough for a spot Bitcoin ETF?

J.W. Verret: I think it’s already big enough. And if the SEC were judging the Bitcoin spot ETF applications by the same metric they’ve used in the past for other ETF applications, they would have approved it already in the same way that Canada and Germany have and the same way I expect Australia will eventually. So I think we’re just behind other comparable nations. And it would be nice if the SEC said, ‘Look, here’s what’s required in order to obtain full approval.’ It’s also interesting to that the SEC recently approved a futures ETF application is based on the 33 Act and not the 40 act. In that way, SEC Commissioner Gary Gensler has already crossed the red line that he previously said he wouldn’t cross with respect to Bitcoin ETFs that gives a lot more wind behind the sails of folks like Grayscale and other applicants for Bitcoin ETFs. I think it’s just a matter of time.

Brady Dale: Can you explain the red line he crossed?

J.W. Verret: He said that he was one of the problems with the (..) ETF application is that it would be approved on the 33 Act. It wouldn’t include all the strictures that are included under 40 Act classifications, essentially mutual fund regulation which are a lot stronger in terms of the paternalistic approach the SEC takes in regulation of those ETFs. So in that sense, it’s a red line – that whittles away some of the arguments he’s had against spot ETFs.

Brady Dale: So, just so we get it… the previous Bitcoin ETF – a few have been approved. But, they’re all in the futures market, and they were under a more strict set of rules. And this most recent one is under a slightly looser set of rules?

J.W. Verret: Exactly right. And that looks a lot more like a spot ETF would under the 33 Act. It would be nice if he said, ‘Look, here’s the size I need to see, the more surveillance I need to see, the anti-manipulative safeguards I need to see before I will approve it.’ He hasn’t said that. All he says is they’re not enough. But when you look back to other ETFs that have improved in the past there have been some pretty shady ones that have been approved and are essentially negative net present value prospects at inception and the SEC approved them anyway. So I think it’s time.