With an estimable blizzard of content in the rear view mirror, here’s a selection of key takeaways from Circle’s Converge22 conference in San Francisco.

Circle is the maker of USDC, among the most widely used stablecoins today, which is nearing a market capitalization of $50 billion according to Coinmarketcap.

Takeaways include:

Read them all…

Takeaway #1 – dreamforce for crypto

The positioning for the conference as stated by Circle executives was “Dreamforce for internet finance” not “Dreamforce for crypto.” But, last week in San Francisco felt like a conference with a largely crypto audience. Still, this comparison – crypto vs internet finance – reveals the core of Circle’s ambition and the potential it sees with crypto innovation.

For their first-ever “ecosystem conference,” Circle programmed a three-day multi-track agenda featuring topics related to key strategic areas for the company such as stablecoin uses, regulation, privacy/identity, compliance, lending, financial inclusion and more.

Circle CEO Jeremy Allaire stated that over 2,600 attendees made the trip to San Francisco and added, “We always thought of USDC as a protocol that people can build on.” And now the event will exhibit the different dimensions of what people and companies are doing with that protocol, he said.

Takeaway #2 – stablecoin legislation

For government policy wonks, Cricle provided an update on stablecoin legislative progress in Washington.

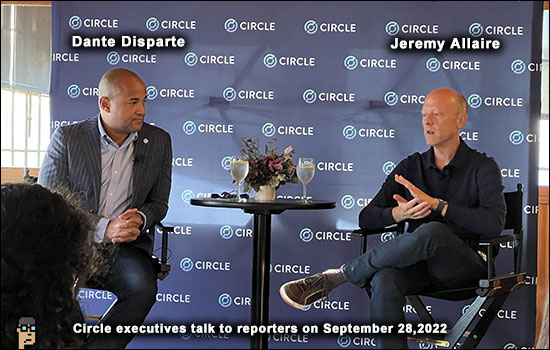

Circle’s Chief Strategy Officer & Head of Global Policy, Dante Disparte, took the lead in discussing the latest. He joined Circle in 2021 and has a deep background in DC advocacy including time spent at Diem, the Facebook currency project.

Disparte seemed optimistic on legislative momentum even though DC may feel “a little vindicated right now following Terra and the crypto moment that we’re all in. And you even see it as a press pool. You feel like the White House Executive Order has been timestamped to crypto’s riskiest phase as opposed to forward looking and opportunity drift.”

Nevertheless, Disparte said the Digital Commodity Consumer Protection Act (DCCPA) and the stablecoin bill co-created between Chairwoman Maxine Waters in the House Financial Services Committee, and Ranking Member Patrick McHenry were showing progress.

On the stablecoin bill, he said:

“If passed, and if debated, would be on the one hand an answer to what the President’s Working Group on Financial Markets has called for in the sense of urgent action to start normalizing this innovation, addressing things like bank-like risks, addressing the prospects of runs and loss of confidence. All of the long laundry list of ills this industry can create if they remain unchecked will be answered in this bill.”

As for timetable on a stablecoin law, Disparte expressed optimism in spite of looming mid-term elections and the end of the Congressional session. “There’s a nonzero chance that this could be tabled, marked up and even potentially passed this calendar year. But, 2023 represents a period of time where you can see a breakthrough from the regulatory perspective.”

Importantly, if the Waters-McHenry bill is passed by the House, he saw relatively clear sailing from members of the Senate Banking committee: “What I’ve heard from individual members of that committee is that if a good bill shows up at their desks from the House Financial Services Committee, they would dispense with pride of authorship and the need of having to draft a Senate bill that is responsive to the stablecoin question. And they would accept whatever the House produces as a representation of bipartisanship that’s sufficient for them to debate and potentially pass.”

Allaire added later, “I can’t play the odds on on how all these mechanisms work in terms of midterms and lame duck, but, people throw three pointers in basketball games in the last 60 seconds, so we have no idea.”

Allaire was clear that he wanted the world to stop thinking about Circle and USDC as a just a stablecoin company, but as a platform offering and a “Web3 services stack”:

“From the very earliest days, we focused a lot on the ecosystem and getting the developers that mattered in 2018 – which were the early people building DeFi and the next generation of wallets and other things – we focused a huge amount on that ecosystem.

And that’s been a huge part of the success we’ve had – the flywheels that come from having interoperability and standards that people can build to.

So as we’ve grown over the past few years, we’ve just seen that ecosystem grow huge and, increasingly, we organized and thought about ourselves as a platform company. We’ve got a bunch of pillars to that platform. We’re building more and more infrastructure that is available to businesses and developers on that platform. So there’s a lot there.”

In answer to a question on application examples of how USDC acts as a platform today, Allaire admitted it’s still early with only 20,000 Web3 app developers today versus 20 million Web 2 app developers.

He explained more about the “platform” vision:

“Protocols have these platform-like properties. They are network effects businesses – the more people can plug into the protocol, the more utility the protocol has. What makes something like USDC unique is that it’s not just a transfer protocol. It’s actually a particular piece of data – data that represents an actual dollar. It has a currency attribute. Currencies are network effects businesses – the more people who have that particular format of money, the more utility that has as well.

And so we want to encourage that. For us that means building more and more services for developers that help them use that and build that into all kinds of applications. And so I think we’re still super early in this. And Circle itself, you’ll see more and more from us within like the experiences that we provide, that are more platform-like as well, and express the kind of extensibility that one would come to expect out of platform technologies.”

The positioning is reminiscent of other companies such as Cloudflare – arguably the “network” layer of the Internet. Circle aspires to be the Web3 layer… you don’t want to manage blockchain nodes, protocol complexities, custody or security? Fine, Circle says it will do it all for developers who, instead, will concentrate on creating their app -which ultimately gives life to USDC.

A time honored maxim: there is often no better way to learn than by doing.

And that was the point raised by a former Under Secretary of the Treasury, Sigal Mandelker, who is now General Partner, at Ribbit Capital. She participated virtually in a panel discussion titled “Boundaries of Privacy, Compliance and Security in Web3.”

Mandelker believes enabling people in the government with access to the technology that they’re regulating, supervising and enforcing is critical so that they can understand the functional opportunity.

She explained, “If you are working in crypto policy in the US government, you are not allowed to have any crypto. That means the people who are making the rules, writing the report, etc., don’t have the ability to interact with technology.”

To the crypto audience, she counseled that that’s why walking in the regulator’s front door is so important – they need help understanding what’s going on.

It’s an interesting point and makes one consider Congress’ current efforts to curtail its members’ public stock ownership and trading. Is a knowledge gap being created in Congress in the financial markets including crypto?

Takeaway #5 – regulatory advocacy

Speaking to the idea of “platform,” among Circle’s offerings for its ecosystem appears to be regulatory advocacy. Or put another way, “You build. We’ll deal with Washington.”

This puts Circle in partnership – or in competition – with industry associations such as Blockchain Association and Digital Chamber of Commerce.

On a panel regarding titled, “Creating the Future of Crypto Payments and Payroll,” Sheraz Shere of Layer 1 blockchain Solana was blunt: “We let Dante and Jeremy do that stuff for us.” He said his company’s focus is supporting the SOL ecosystem and making sure its network is running well.

The reliance on Circle may also be tied to hopes that US regulatory policy will win out over other parts of the globe.

Francesco Renzi of London-based “asset streaming protocol” Superfluid Finance said on the same panel, “I feel like the US generally speaking is very ‘common sensical’ in the way they make decisions. (…) I happen to be from the EU where we like to regulate before things happen. But in the US generally, I think the approach is different. So I’m quite optimistic.”

In addition to CEO Jeremy Allaire, Circle policy chief Dante Disparte was by far the most featured executive throughout the conference and with reporters.

Disparte emphasized the importance of winning the policy war in the name of crypto innovation:

“We think it’s an important issue not only as a matter of normalizing the space – as a company, we are hiring people in more than 35 states in the United States and 12 countries. We think it’s an important part of the storyboard around US economic competitiveness and what the White House Executive Order was calling for in the first place with its crypto E.O. around creating a platform for these innovations to be normalized in the US.”

It would not be surprising to see Senator Pat Toomey (R, PA) working for Circle once his term ends in January. What this conference made clear is that the biggest risk to Circle or any crypto company is regulatory.

Takeaway #6 – expression of the dollar

Is USDC a US dollar? Allaire disputes a direct comparison and sees the answer as nuanced: It’s “a new expression of dollars in the US financial system, and by extension, in the global financial system.”

Outlining how USDC connects to the existing dollar infrastructure, he explained how the stablecoin gets to what he calls “the purest form of dollars,” i.e. the debt of the government and two forms of obligations:

“One is you’re going to give the government a loan for three months, and we’re gonna pay you back in three months. That’s one form of debt money.

The other is the Federal Reserve says if you give us your dollars, we have the ledger and these are backstopped by us. And so unless there’s total collapse in the whole world, that ledger is not gonna change and it’s gonna be O.K. And so it’s cash at the Fed and the government debt over the next 90 days. That is the purest form of the dollar. That is what we seek to approximate. That is what we are doing.

We think that government debt money in that form – connecting that and operationalizing that on public internet infrastructure, on public programmable, composable, infrastructure – is an extraordinary opportunity.

And, it’s a hybrid model. We do not seek to overthrow the sovereign. We’re not suggesting that we should have a world where there’s not sovereign money.”

Dante Disparte added, “It’s not competition with the dollar. It’s about moving the dollar and an expression (of it) on the internet that improves its transmissibility.”