HFS markup – SAB 121

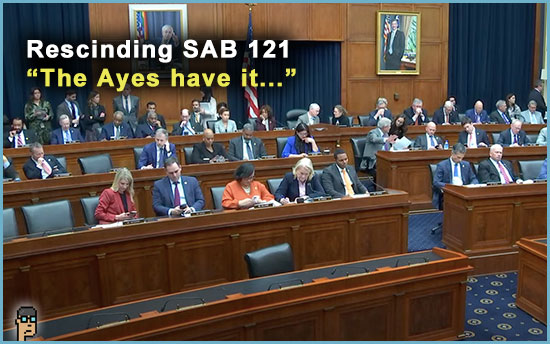

At yesterday’s abbreviated House Financial Services markup (video is here), the Committee sent two digital asset-related bills to the House floor.

The House Joint resolution rescinding the Securities and Exchange Commission’s (SEC) controversial Staff Accounting Bulletin 121 (SAB 121) sponsored by Reps. Mike Flood (R, NE) and Wiley Nickel (D, NC) was approved by a final tally of 31-20… all Republicans and 3 Democrats (Rep. Nickel, Rep. Ritchie Torres (NY), Rep. Josh Gottheimer (NJ)) voted for the bill.

From the Majority press release:

-

- “H.J.Res.109, providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to “Staff Accounting Bulletin No. 121,” offered by Rep. Mike Flood (NE-01), overturns the SEC’s SAB 121. By overturning SAB 121, the Resolution will ensure consumers are protected by removing roadblocks that prevent highly regulated banks from acting as custodians of digital assets.”

Video of Rep. Flood’s hearing comments are here as he makes a detailed case for the bill with Members.

Jake Chervinsky, formerly of Blockchain Association and currently Chief Legal Officer of Variant Fund, was heartened by the “good news” of the bill’s passage out of committee but noted on X, “Bad news: that’s likely the end of the story in Congress. Getting repeal done is nearly impossible. Lawsuit or bust.”

Chervinsky doesn’t see the bill taken up by the Democrat-controlled Senate or signed into law by the White House.

what you should know: It will be interesting to see the strategy employed in the Senate by the joint resolution’s sponsor Senator Cynthia Lummis (R, WY). Is there a sympathetic Democrat who can help? Perhaps. Senate Finance Chair Ron Wyden (D, OR) partnered on a Congressional letter regarding the SEC X account hack with Sen. Lummis in early January. Continue reading “SAB 121 Joint Resolution Approved By Financial Services; New Amicus Brief For Kraken”