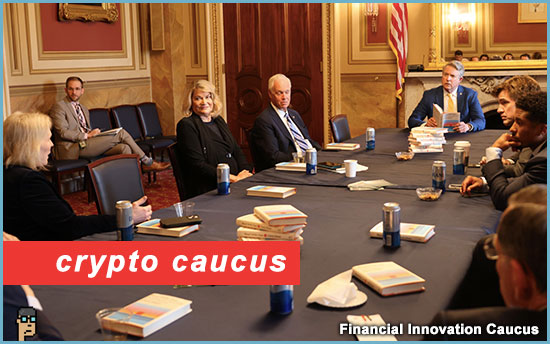

crypto caucus – Senate

The Senate version of the House’s dormant Congressional Blockchain Caucus awakened last week with a revealing photo op. Known as the “Financial Innovation Caucus,” it was originally founded by Sen. Cynthia Lummis (R, WY) and Kyrsten Sinema (I, AZ) – see the Caucus landing page.

The Caucus’ X account announced in a tweet on Friday that senators had gathered together with a16z crypto venture investor Chris Dixon, who released a new web3 book at the beginning of the year called, “Read, Write, Own”:

“This week, [Chris Dixon] joined the Financial Innovation Caucus for a bipartisan discussion about the importance of crypto assets and the need for the U.S. to be a world leader in regulatory clarity for crypto assets.”

Sen. Lummis office confirmed to blockchain tipsheet:

“Since she arrived in the Senate in 2021, Senator Lummis has been committed to helping educate her colleagues on a host of issues related to bitcoin, crypto, web3 and blockchain in general. Mr. Dixon recently published a new book on the evolution of the internet as well as the role blockchain technology can play in countering the overreach of big tech, so Senator Lummis invited him to meet with her colleagues to discuss.”

“The overreach of big tech” – that’s something that appeals to both sides of the Senate aisle

Senators who were present for the Caucus meeting included:

-

- Sen. Lummis and Sen. Kirsten Gillibrand (D, NY) who co-sponsor the Lummis-Gillibrand Responsible Financial Innovation Act (RFIA) [S.2281]

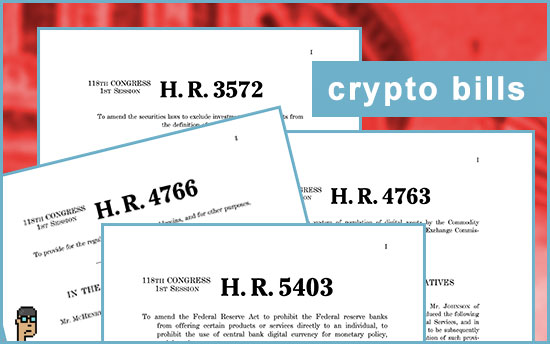

- Rep. Wiley Nickel (D, NC) – A member of House Financial Services, Nickel has supported both the stablecoin [H.R.4766] and digital asset market structure [H.R.4763] bills awaiting votes on the House Floor.

- Sen. Ted Budd (R, NC) – He supported digital assets legislation consistently as a Member of House Financial Services and became a Senator in the 118th Congress.

- Sen. John Thune (R, SD) – co-sponsor of the now-defunct Digital Commodity Consumer Protection Act (DCCPA) [S.4670] from the 117th Congress. Thune is also the Senate Minority Whip.

- Sen. John Cornyn (R, TX) – considered pro-crypto and has sponsored introduction of legislation dealing with crypto’s use on the Dark Web [S.1728].

- Sen. John Barrasso (R, WY) – Sen. Lummis fellow Wyoming Senator. Member of the Senate Finance Committee where Lummis-Gillibrand’s RFIA is currently assigned. Also, he’s Ranking Member of Senate Energy and Natural Resources.

- Sen. Ron Johnson (R, WI) – Member of Senate Finance Committee.

- Sen. Roger Marshall (R, KS) – Member of Senate Agriculture with Sen. Gillibrand. See more below.

Continue reading “Senate Crypto Caucus Convenes; Reviewing Oil Versus Digital Assets Sanctions”