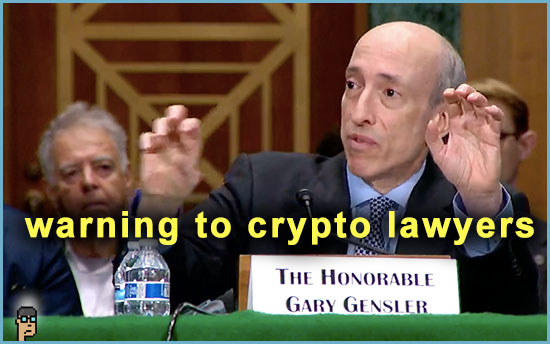

warning crypto lawyers

At a continuing legal education event run by the American Bar Association last Thursday, Securities Exchange Commission (SEC) Chair Gary Gensler participated in an interview where he offered his view on lawyers involved with crypto clients.

Fintech policy publication Capitol Account, which covered the event, reported that a show of hands revealed roughly 40% of the audience’s lawyers were working in crypto. Gensler responded, “That’s your field, if those are your clients…without pre-judging any one of them. And the public if they lose trust in this little area (crypto), this little corner of the market, and you as gatekeepers facilitate that? That hurts the rest of the market, too.” Read more in Capitol Account.

more tips:

Crypto publication CoinDesk named Chair Gensler to its 2023 Most Influential list last week. In appreciation, the Chair responded on X on Friday, “Thank you @CoinDesk, I guess?”

what you should know: The message coming from Democratic leadership – including Chair Gensler – to industry remains, “If you touch crypto, stop touching.” Its message to voters is “We are going to stop crypto in the U.S.” The big question: will voters care enough to make it a needle-mover in the 2024 general election one way or the other?

SEC sanction update

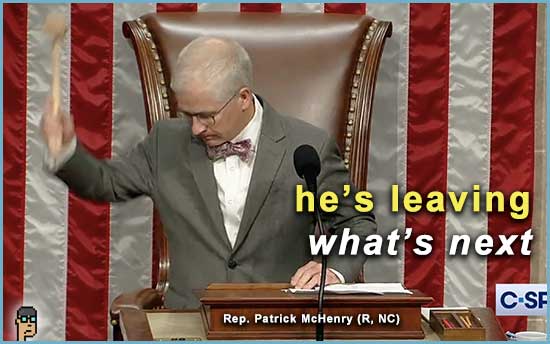

“The [Securities and Exchange Commission] wants more time to respond to a judge’s accusation that it made ‘materially false and misleading representations’ in a lawsuit against the crypto company DEBT Box.” Fortune reporter Leo Schwartz on X Continue reading “Crypto Lawyers Get Warning From SEC Chair; McHenry Talks 2024 Agenda”